Chapter 10

The Rising Tide Lifts All Boats

In retrospect, though, during the mid-1990s the old-line publishers were mostly repurposing their print products and not investing much in real innovation. Times were good, and the core products were pumping out cash.

The fact is — hindsight is 20/20 — it was a small effort [at the outset], a small experiment, with a very small impact. For most people in the organization, it really didn’t touch them very much. It’s not that people were hostile, or that they didn’t want to do it. They just didn’t care very much, to be perfectly honest.

In late 1995, for example, The New York Times quoted Time Inc. CEO Don Logan’s memorable response when asked how much his company had spent in the past year to develop the Pathfinder portal: “It’s given new meaning to me of the scientific term ‘black hole.'”

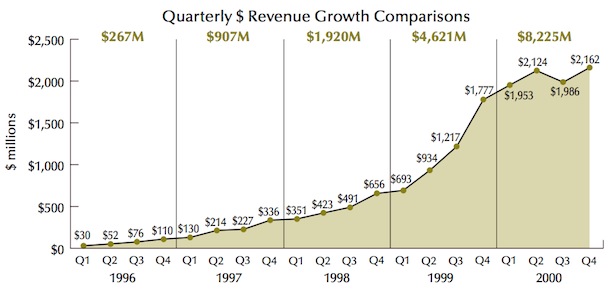

Despite that he had once been a computer programmer at NASA and a PhD candidate in mathematics, Logan was immediately denounced as a Luddite. The real issue, of course, was that the “new media” companies weren’t chasing profits at all, but rather “valuation” by Wall Street. Even with precious little to show on the earnings or asset sides of their ledgers, many of these companies came to be valued with market caps exceeding those of their “old media” competitors. This phenomenon created a generation of instant dot-com billionaires and turned Silicon Valley into an object of media fascination that garnered as much ink as Hollywood, Washington, or Wall Street.

By far the most spectacular — and somewhat bizarre — event of this whole period came in January of 2000, when Jerry Levin and Steve Case stunned the business world by announcing that AOL, valued by the market at $163 billion, would pay $182 billion in stock and debt to acquire media titan Time Warner, valued before the deal at $83 billion. The creator of “You’ve got mail” suddenly owned Warner Brothers, Turner Broadcasting (including CNN), HBO, Time Inc., and Time Warner Cable to boot.

It wasn’t until AOL started to become the leader that I thought, “That’s going to change every part of our business. We better get on the bandwagon….” At first we thought we could develop all of this internally….

You [couldn’t] turn this battleship [Time Warner] around, much as I would’ve liked. So we went to the next strategy, which is you acquire it. We thought, “Yahoo would make a lot of sense.” [But] Jerry Yang was not interested.… [Then I was at a dinner with] a group of CEOs…. Here I’m Time Warner. Biggest company in the country. I’m media. This other guy, Steve Case, is there. All everybody wanted to do was talk to Steve Case, wanted to hear about AOL. What’s AOL doing? I thought, “Pretty Interesting.” So we started to talk. [He] had a very good board. Was actually making money. My assumption was, based on all this history, that you couldn’t take journalism and turn it around.

By this time, we had CNN. I had my ideal of a video news service. But it was all going to change and somehow was going to affect all of the businesses. We better get part of it, or it’s going to disrupt or eat our lunch. A lot of this is the reason why we put AOL and Time Warner together.

Of course, the deal is now generally regarded as the worst disaster in the history of corporate acquisitions. Current Time Warner CEO Jeffrey Bewkes, who, as HBO CEO at the time, was hostile to the deal, has since called the deal “the biggest mistake in corporate history.” But while it ultimately resulted in a loss of around $200 billion in market value for Time Warner shareholders, it did nevertheless turn out to be a great financial windfall for Steve Case and his AOL shareholders who, had they held on to their digital-only company for the market collapse that was soon to come, would have suffered precipitous losses.

There are as many versions of this story as there were AOL/Time Warner employees. At least three books have been devoted to the subject (including Fools Rush In by Nina Munk, Stealing Time by Alec Klein, and There Must Be a Pony in Here Somewhere by Kara Swisher).

Why did the merger fail? Why did this notion of combining AOL with the broadband access with the greatest content brands fail?

I think it’s a lot of things, but the core of it is around execution. I think the idea of that merger, from AOL’s perspective and from Time Warner’s perspective in terms of the strategic drivers of what’s happening with these markets, what’s happening with technology, I think it made sense for both companies….

How would the execution have been different?

I think it’s all about people. Thomas Edison famously said a century ago, “Vision without execution is hallucination.” I think that was part of the problem. In retrospect, because Time Warner itself was a company that was essentially built through a variety of different acquisitions and mergers and AOL came into that world, we saw the world converging. We saw operating this as one company to try to be the leader in this new and digital world….

I think it ultimately came down to people and cultures…. If the top 50 executives of the combined AOL and Time Warner companies had all been fired, and you called a central casting to replace them, and 50 new people that were not focused on the past but rather on the future were in charge, I think it would have worked out better.

This colossal deal didn’t just have negative financial consequences for the merged companies, it also contributed to a grinding halt to most digital strategy development at the Time Warner legacy divisions.

There was a thought that there would be this synergy, not just between AOL and CNN, but among all — Time Inc. and Time Warner and AOL…Netscape, and some other things like that. CompuServe, which they had a piece of at that point. That whole year of 2000 there were all these attempts: “Let’s have about 100 meetings a month to try to figure out what these synergies are.”

We would place some links into some AOL property, but we didn’t have that really direct pipeline that MSNBC had from MSN. AOL was a little bit on the decline user-wise at that point, too, because of the rise of broadband, so you could argue that the quality of traffic they were driving probably wasn’t as good as what MSN was driving.

As far as I can remember, we [CNN.com] never overtook MSNBC in unique users while I was there.

As much as anything, that [merger] led to my departure…. Upper management went through a lot. My boss changed about five times in five weeks, and there was the whole Time Warner corporate level…which gave yet another layer of management. So it was difficult.

The dot-com boom starts, and all of a sudden we’re seeing people leave the [New York Times Digital] organization. We can’t hire people because people are expecting stock options. By 1998, I would say it was clear that something much more — let’s just say interesting — was going on than a small-bore experiment.

At that point, Russ [New York Times CEO Russ Lewis] decided we needed to break out [digital] into a totally separate operation. I believe he had read The Innovator’s Dilemma by Christensen, and sort of believed that in order for us to truly get some kind of scale here we needed to have our own separate operation.

Tell us about that. What happens?

There was, let’s just say, a very vigorous debate in the company as to whether we should be broken out or not. Obviously, the folks at the newspaper were not happy about losing control of their website, which in many ways I don’t blame them. But it was determined that we would become a separate digital operation…. In addition, we would pursue a public offering of the stock, which…other operations were doing at the time…. Barnes and Noble, for example, had a separate company with its own stock. That was the seminal moment.

I would say the other thing that happened at that point is that we decided…that we really did need to ramp up the engineering side, and we acquired a company called Abuzz, which had been started at MIT. It was a precursor to businesses like “Yahoo Answers” and Quora today. [At the time,] it was called a knowledge management platform, where people would put questions into the system, and the system would find in this vast network of users the five or six best people to answer those questions, send them the questions, and then the answers would come via email. We acquired that business, acquired the engineering team, and began to integrate that capability into The Times on the web. That was in ’99.

Tell us how the public offering comes to an end.

It came to an end in a very strange way. We were working with Goldman Sachs.

We worked through much to the latter half of 1999, and now into 2000. AOL had just acquired Time Warner. We were sitting in a room with our bankers, the Goldman folks. I believe it was April of 2000. Taking a company public, you work very closely with your bankers. You’ve created this thing. It was actually a tracking stock. We created this document called an S-3, which is like an S-1 except for a tracker [stock].

We were rehearsing the road show at that point…. I think people were still carrying beepers. Remember those little beepers? They started to go off all in unison. The Goldman folks basically said there’s some issue…I think the market was actually diving hundreds of points that day. They went back to Goldman, but they said, “We’ll be back tomorrow to rehearse again.”

We never saw them again. Because the dot-com boom was over, so there was no IPO.

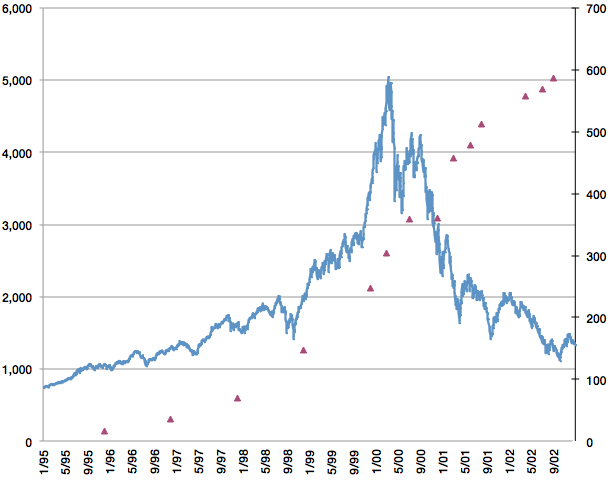

Other than the obvious irrational exuberance, pundits and others have speculated over the years about exactly how and why the bubble burst in 2000. Some have suggested that AOL’s acquisition of Time Warner signaled a top so irrational, so cockeyed, that the market simply collapsed in disbelief. But whatever the reasons, the pullback of April, 2000, was the harbinger of what Nisenholtz now calls the “Web Winter,” which began in earnest in January of 2001.

By then, the whole country was beginning to feel the effects of the dot-com bust and attendant market selloff. Most Internet news organizations endured steep budget cuts in an attempt to rebalance the lost revenue from the disappearance of banner ads and the lofty valuations that were now a part of history.

Like many big media companies, The Times needed to retrench some. I was told, “Look, you got to find a way to get this thing profitable. We’ve invested a lot of money in it.” [Then] 2001 dawns, and in January we had our first series of layoffs, and then in April it became clear that the recession was going to be even deeper. We had a second series of layoffs. We did manage to at least get the business to cash-flow profitability by the end of 2001.

How big a business is it? How many people are in it?

I’m going to guess, at that point across the company, maybe 140 people. But we probably lost 40 percent of them in 2001. It was really taken down. I’d say that the revenues at that point were maybe $25 or $30 million. Remember we also had this B2B [business-to-business] entity embedded in the overall business that included our LexisNexis deals and others. I almost don’t count that money because it wasn’t dot-com money.

The consumer business, the dot-com business, was very small?

Well, yes. Once the dot-com bust happened, it got very small, very fast…. Now I do want to say that from a usage perspective, the dot-com bust didn’t do a thing to our usage curve. Our usage curve was a straight-line growth.

This was all about advertising. Right? …The economic model had eroded?

The economic model had collapsed. It hadn’t eroded. It just collapsed. It was very, very difficult to sell Internet advertising. In fact, [we] started the OPA [Online Publishers Association] in 2002 because the buzz on Internet advertising was so bad that I felt the industry needed to come together and put a fact base out there that at least said, “Look, there are these users who are actually using these services, and they actually see these ads, and they respond to them in these ways.”

Ironically, many strategists in the legacy media companies breathed big sighs of relief. All the anxiety and irrational exuberance of the dot-com boom were now fading into what appeared to have been just a bad dream. Mainstream operators could go back to making money the old-fashioned way, doing what they knew best — publishing newspapers and magazines, or running network and broadcast television companies — and selling ads at comfortable, high margins. The very word “dot-com” became a joke, a symbol of nothing more than an over-hyped future foisted on an honest industry by a group of Silicon Valley hucksters and their bankers.

Sign of the times: A young blogger named Philip J. “Pud” Kaplan launched a site in 2000 called fuckedcompany.com to catalog the disaster. For a brief moment he became a minor star and even published a book of the same name. The site was shuttered in 2007.