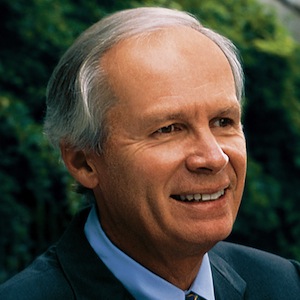

Martin: Martin Nisenholtz and Paul Sagan are here with Tony Ridder in beautiful Pebble Beach on April 8th, 2013. Why don’t I start with a general question, Tony. I started my career in 1979. I started, actually, working at NYU on a Teletex project. It quickly came to my attention that Knight Ridder was working on videotex. You go back to the history of the industry. Knight Ridder was there at every turn with some of the most innovative stuff going. Can you talk about the very early days and why Knight Ridder pursued these projects…particularly the Viewtron project, which comes up over and over again as a seminal, beginning event in the interactive industry.

Tony Ridder: Even though the videotex project didn’t work out, I can’t take credit or the blame for it. It was really somebody by the name of Hal Jurgensmeyer, who had been general manager of the Miami Herald and then he was the senior vice president of Knight Ridder. I think, more than anybody else, it was his baby. I was then the publisher of the San Jose Mercury News. I thought it was really exciting. I thought it was going to be bigger than it turned out to be. I was always very much in favor of what they were doing. Hal was my boss. I reported to him. He would talk to me about it, but it was his vision.

Martin: Right. So you were out here at that time, and…

Tony: I was out here. I didn’t move to Miami until February of 1986.

Martin: OK.

Tony: Then when I did, it was not doing well. I went on the executive committee of the company and they were already talking about how we do get out of this thing? The next phase, I was very much involved in that.

Martin: Right. Do you think, just in general, because obviously Knight Ridder wasn’t alone here. Times Mirror had a major videotex project called Gateway…

Tony: Right. We were both doing basically the same thing.

Martin: Yeah. But both of them were very large projects and they both came to an end, and I actually worked on both of them. For whatever set of reasons, and we can all speculate on why it happened, they didn’t work. Do you think it cooled, the newspaper industry’s desire to invest in this area for a while? It seemed like everybody retreated after the videotex era.

Tony: I don’t know the answer to that. I do know in our case I was critical of the fact that they were doing it in Miami. Just because our headquarters were in Miami, it was clear to me that San Jose…if we want to really understand if something like this can work, why are we not doing it in San Jose? The answer was, well, because we’re down in Miami. I said that’s not a very good reason as far as I’m concerned. This is the kind of place where if it’s going to work anywhere it’d work here. Why don’t we try it here? Why try it in a place that’s not very technologically savvy?

Although people in Miami said, when we moved to San Jose, said, well, we’re just as good as any other part of the country. But they were not technologically savvy. I thought that was part of the problem. But even if it had been in San Jose I don’t know if it would have worked because it was expensive.

Martin: It was a tortoise and the hare thing, too. I think the theory was that the TV set and the telephone network existed. You just needed to put some coding technology to join them. The PC was so nascent, but the PC was like a tortoise. It just kept growing and finally AOL caught on. OK, so fast forward a little bit to the early ’90s and now you’re running the company. Mercury Center, one of the truly innovative, really, I think the first… I think you joined with AOL at that point, right?

Tony: We joined AOL. We were the first customer of Netscape. But what happened is that Jim Batten was then the chairman and CEO, I was the president, and Jim and I talked about this. I appointed a committee to try I mean, of some really smart, young people, to come up with some really breakthrough ideas. One of them being an electronic, second generation of the videotex where we could use the dialup service and…because it was clear, even though this is ’92, I think, and it was about six years after we had shut down videotex that there was really something there. There wasn’t Internet available at that point, but there was AOL, and so we became a customer of AOL.

I’d been the publisher of the San Jose Mercury News, Bob Ingle was my editor. Bob Ingle loved electronic systems. Before he was the editor of the San Jose Mercury News he had been in charge of the installation of the system in the Miami Herald newsroom. He drove the system of the Miami Herald, the front end system, and he loved that stuff. He was playing with it all the time, he would talk a lot about it.

He was on the committee and he was, I asked him to lead that part of it. He loved it. It was a natural for him. Even though he was a very good editor he had a strong interest in that. And so Bob really took the lead, and this time we weren’t going to make the same mistake. We were going to do it in San Jose, start in San Jose.

Paul: Can you speak about the vision of what you thought the product would do? How did you think about it in terms of the newspaper product, the 24 hour cycle versus the once a day cycle and all the things that cable news promised?

Tony: I think that we thought it would be the newspaper in live form. Not just putting up the newspaper, but it would be the newspaper in live form, and we would offer these other services that we would have, a retrievable service so that people could access past copies of the Mercury News, and that they could search for other kinds of information. It was clear back then that the world was moving in that direction even though the Internet was not actually available. Because we were the first customer of Netscape.

Paul: So the prior stuff was all walled garden. Only AOL and Mercury Center, it was a closed world.

Tony: But it was clear that the Internet was coming. The Internet was there, but it was clear there was going to be a better way of doing it than a dial up service.

Martin: But you charged a fee at that point, I think. I think you charged a fee for the service, initially. For the first service. Yeah.

Tony: Yes. Well because you had to pay for the dialup service.

Martin: For the dialup service, right.

Paul: And as I recall it had tens of thousands, some number of subscribers. It was a real thing then. It was not just a test. It caught on.

Tony: It was, yes. But then when Netscape came along and when we could go up on the Internet… It’s interesting, when you look back on it now. People were saying, well, ‘These newspaper guys never saw this coming.’ I used to say, ‘We are not going to be a buggy whip company. We are not going to miss this wave. There’s something here and we’re going to be part of it. We’re not going to worry about making money for some period of time. We’re going to get on top of this thing.’ But even though we spent all this money, we never really…

Martin: We’ll get into that in a second. One of the interesting stories that we’ve read and I assume it’s true, is that when you took over the company, one of the people in the newsroom asked you what kept you up at night. You talked about classified advertising, which was very prescient at the time, but it was looked at, in the newsroom, as, “Why would that keep him…” As a low end worry. It turned out to be exactly the right worry. Maybe there’s something in that story.

Tony: As you know, as you both do from being in the business, newsrooms get criticized for being liberal. But newsrooms are the most conservative organizations anywhere. They are so hidebound. The editor of the [inaudible 10:54] wrote a book. I was a quote in the book. I would have an editors meeting at least once a year. I would always talk to the editors and ask for all their questions. That was one of the questions. It was like 1994 1995. ‘What keeps you up?’ I said, “Electronic classified. I think it could really make a big difference to our business.” What they really wanted me to say, I guess, was that we don’t spend enough money on journalism or something.

It was clear to me that people were going to figure out how to deliver classified in an electronic form. We were going to do it too. But that was going to eat away at this great business that the newspaper industry had, with classified advertising in print form.

Martin: The first thing I recall, when I joined the company, The Times Company, the following year, was something called Career Path. Russ Lewis, from The Times side, joined this consortium.

Tony: I used to meet with Russ. [laughs]

Martin: Right. And I remember that’s when I first met you. It didn’t work. It just fell apart of its own weight. I guess the reason is that companies just couldn’t work together?

Tony: I think the problem was that we were all very independent. We might have belonged to the Bureau of Advertising, we might have all been part of the ANPA and Newspaper Association of America. But we did our own thing. I would talk to Russ and Arthur and my counterparts in other companies. We were all friendly. Career Path was the first time we had to give up something to make it work. The New York Times had their ideas of how to do things. We had ours. Trying to get everybody to work together just didn’t work. We had The Tribune Company. There were like eight companies.

Martin: At least eight.

Paul: JVs are hard.

Tony: What?

Paul: JVs are very hard.

Tony: We tried other things. We had new…

Martin: New Century Network, which also failed.

Tony: What finally happened… I don’t know if I’m getting ahead of you here.

Martin: No, you’re right on.

Tony: What finally happened is, John Madigan, from the Tribune Company, called me and said, ‘Tony…’ As we talked about, we really screwed this up. If it’s going to work, it can’t just be Knight Ridder. It can’t just be New York Times. We’ve got to do it as an industry, to get enough impact, to have a national footprint. Madigan called me and said, ‘Tony, what do you think about just the two of us going in and buying Career Builder. Let’s not get anybody else involved. Just the two of us.’ I said, ‘Maybe we ought to have Gannett in there. They are the biggest.’ We were the second biggest newspaper company, in terms of our footprint, our circulation, our size. Tribune was third. As a company, The New York Times was about the same as Knight Ridder, but they had other things back then. But just pure newspapers.

We talked about Gannett. He said, ‘But Tony, I’m afraid we’ll be heading down the path of what didn’t work before. This way, just you and I. We can cut out everybody else. Just if you and I can agree, that’s all it takes to get things done.’ So that’s what we did. But then it became clear… I can’t remember the timing. It was like a year later, we bought another company. You may know the…

Martin: Headhunter, I think.

Tony: Yes. Then we decided that it would be wise to bring Gannett in. But by then, we had it working. We had a structure. It wasn’t going to be like Career Path. Instead of trying to start a company, we bought a going company. We had good management. They were getting good compensation. That was all working well. It was a real business. So we brought Gannett in, as a partner.

Martin: That worked. Both in terms of the jobs, as well as Cars.com, which was the Classified Ventures piece.

Tony: Right. So what we did was, we had six people. We had the management. I think it really turned out that Jack Fuller and Gary Watson and I, Gary Watson from Gannett, and then I did it from Knight Ridder and then the three guys that were running the systems. So there’d be six of us, and we’d meet and that’s sort of how it went.

Martin: So what’s interesting about that to me is that it worked, and yet it wasn’t enough. It wasn’t enough to overcome the downward spiral, and I’m just wondering why?

Tony: Well, it was just a part of it. You know, the problem with the downward spiral is that even though that worked, and you would know this better than I would, but I think that Career Builder is the biggest today. I mean Monster was the biggest back…they were our primary competition…

Martin: Yeah, back then, yeah.

Tony: …but they’re the biggest today. But the problem is that, you know, to get results from Career Builder costs, I don’t know, 15 percent of what it used to cost to get it in the print ad, so we were undercutting our business. But we always said from the start, even though this was really kind of created a lot of internal tension, but I always said, ‘Don’t worry about eating our seed corn. We’re going to build the best Internet company we can, and it’s going to mean we’re going to take business away from the print.’ But that was very difficult to do. And publishers would say, ‘All right, Tony, that’s easy for you to say, but you’re putting pressure on me to perform, and I’ve got more revenue from the print.’

But that was always a tension in our business is that, you know that we were always…we were trying to run a public company where we had…we were being compared to Gannett and Tribune and New York Times, and we had profit pressure. And, you know, I would say, ‘Let’s build up the Internet business as big as we can. Let’s devote the resources to it.’ But within the newspapers…

Martin: So let me add that one of the things I mentioned to Paul on the way down was, you know and it’s probably was never possible but was there a moment when you thought to yourself, ‘Maybe we should take this private so we can make this transformation?’ because as you say, as long as you’re managing to the street you don’t have the flexibility to make the investments necessary and certainly not to cannibalize your own business?

Tony: Well, and we talked about…what was popular back then was tracking stocks.

Martin: Yeah, which we were doing.

Tony: What?

Martin: NYTD was created to be a tracking stock.

Tony: Yes. All right. So we were headed in that direction, and we had permission from the board. We were going to do it, but then I think that…you know, I retired six years ago, and I can’t remember the dates as well, because it’s now about 12 years ago, but I think what happened is then we went into the downturn the end of 2001, and we kind of shelved the tracking idea.

Martin: It was April 14th, 2000 in case you’re looking for the date [laughs] .

Tony: But we were going that way.

Paul: He remembers it well.

Martin: I remember it very well.

Tony: And the board, we had all these internal debates with the board. But, yeah, then so we sort of just pushed that aside, and sort of muddled through that downturn, which was pretty severe, and that’s when we really got hit on the employment classified side.

Martin: Right. Well that was a cyclical…that was a recession that we never really came back from after that.

Tony: Yeah, and it was interesting how people thought…which we didn’t, but so many people thought that, “Oh, that was just a passing fad,” but we never thought it…I’m sure you never thought it was either, because there was enough there. It was just that there was…people sort of lost their sense of reality, and they didn’t worry about making money or when they were going to get to making money. I mean it was just an unreal time, but there was something that was really there that wasn’t just going to go away, that’s for sure.

Paul: And you were living in that, and you made the comment about running a business in Silicon Valley and watching an experiment in Miami, the wrong place, and we’ve talked to a lot of people, and one of the themes that’s emerged is just how important it was to have engineers and be an engineering based company that succeeds. You look at Yahoo, which even might say it lost its way as an engineering company and certainly Google, and Facebook, and Twitter, and on and on. How did you think about that living in Silicon Valley and seeing what was going on and trying to morph the newspaper business into a tech company?

Did you think it could be done by grafting engineers in? I mean you certainly had some of the most visionary people in the media business working for you.

Tony: Well, I mean, my thinking was despite people saying, like Jack Wells, “You know it’s all about Tony Ridder wants to come out and play golf at Cypress Point here in California, or whatever, but it was trying to get the top people in the company, like the top corporate people, the top 15 or so, to really understand the mindset of how people in Silicon Valley look at things and to have the ability even though we were set up out there with…you know, we later called it Knight Ridder Digital. I forgot what we were calling it back then. Maybe you know, but we had people there, but yet we were sort of…the power was down in Miami, and so we wanted to be able to attract people and have them out there, and have people sort of think the way they do.

So when we went out there in 1998 we went out and met with all these companies. We tried to get inside their head about how they do things, and we took all the people doing all the corporate stuff and tried to immerse them in the kind of thinking that people have out there, which I thought would make a difference.

Martin: But I think Paul’s point, and what we keep hearing over and over again, which is an interesting…there’s an interesting paradox inside of it is, the people who create innovation in the Valley, and to some extent now in all the centers of innovation, including New York, are people who really understand the engineering. They don’t necessarily have to be trained computer scientists. Sometimes they’re high school students [laughs]. I mean, I interviewed Matt Mullenweg this morning who founded WordPress as a freshman at the University of Texas. He was a philosophy major. But they understand code. They understand.

And the newspaper industry, the media industry in general — let’s not pick on newspapers magazines, television — just never really understood how to incorporate these talents into their lead…not just their companies, but their leadership processes.

And yet when you talk to people in the…particularly in the journalism business they’ll say, ‘Well, we’re not tech companies. This isn’t Facebook. We are a news company. Obviously the people who run the company need to be news people.’ So that’s the tension that I think we’re hearing over and over again when we do these interviews, the tension between technology innovation and sticking to your knitting as a news company.

Tony: Well, I mean I think that trying to…I mean you sort of look at what’s happened to Microsoft when they get big, kind of corporate, profit-driven. If you’re a smart PhD from Stanford, let’s say, do you want to work for a big company like that, or…? So even though Knight Ridder — and back then Mercury News was a really good newspaper, and it was sort of an exciting place, but if you were a really smart guy, and you are thinking, ‘Should I try to…’ there was so much money available.

Martin: There still is.

Tony: Yeah.

Martin: Yeah.

Tony: So do you want to try to work within Knight Ridder and try to build a business within Knight Ridder or do you want to try to do it…because you know there are a lot of kind of old crusty people like Tony Ridder there, and they…or do you…this way you can do your own thing, and you can get money, and you’re not bound by…you know, Knight Ridder worries about making money, and New York Times, and all these other companies. Why not just do our own thing and have our own company and not be part of a bigger company? I mean we don’t want to go work for GE or some company like that. We want to do it within our own. And when you go back to the history of Intel, you know Intel, they ended up with Fairchild.

They went around looking for all kinds of money. They couldn’t get it. They finally got their money, and they started Fairchild Semiconductor, and then once they were established they went out and started Intel.

But those same guys first started out in Fairchild because that’s the only place they could get the money, but had they been able to get the money early on, they probably never would have gone to Fairchild, and it would just have started out as Intel, I think.

Paul: You had a lab that did engineering in Boulder.

Tony: Right.

Paul: Talk about that in relation to these other things that we talked about, or if there was no relation how did that operate?

Tony: Well, there was. There was a guy by the name of Roger Fidler. I mean this got involved in the Samsung/Apple lawsuit. And Roger Fidler had sort of come up through the graphic side of the business, and he’d come out of the Detroit Free Press. Did you want more Diet Coke, or water, or anything like that?

Martin: No, we’re great. Thanks.

Paul: No.

Tony: And by the way, Tony, we talked to Roger so we know who he is and what the story is, but…

Paul: And we’ve seen that there’s a film that was produced that showed sort of the vision of the iPad.

Tony: I’ll give you my side of the story, which is maybe a little different from his. He was very independent, very smart. We set up this information design lab in Boulder, because that’s where he wanted to go. Roger was a great promoter, may still be a great promoter. He came up with this idea for what he called a flat panel, which is really just a tablet. It was basically the sort of thing we’re talking about. In 1995, or ’94, we were starting to get going with our Internet operation in San Jose.

Ingle was building it up. Ingle and Roger Fidler couldn’t stand each other. The trouble that Fidler had is that it was dependent on flat panels being available.

I said, ‘We’re not going to go into the business of manufacturing these things. We don’t have the ability to do all that stuff. We don’t have a retail way of selling this stuff. We don’t have a company to make them. What we are…We’ll develop this software. We’ll provide it, but we need these things.’

Roger said, ‘I think they’ll be fairly prevalent within about five years,’ or something like that. At the same time, the Internet was now available. We already were up with Netscape. I said, ‘I think what we need to do, Roger, I think it’s a really good idea…’ He was traveling around the world giving these speeches. It was really exciting.

I said, ‘What we now need to do is we need to spend to a lot of money building up our Internet business. That’s were our focus is going to be. You’re a really talented guy. I would like you to take your staff, move them out to San Jose and be part of that operation. We’ll keep this thing going. When the flat panel comes along…’

‘I’m not going to San Jose. I’m not working for Bob Ingle.’ Ingle, by the way, was not the easiest guy to work for. He said, ‘No, I’m staying here.’ I said, ‘No, you’re not. It’s not going to exist here. We’re putting it all together. It doesn’t make sense to have it in Boulder when we got this going out there.’

That’s how it all fell apart. It is interesting how it turned out to be the same. It wasn’t just five years from ’94. It was, when did the iPad come out?

Martin: 2010, I think.

Tony: Yeah. It was really like 15 or 16 years.

Paul: It was a classic example of overestimating the short term impact and underestimating the long term, right? It wasn’t five years, but 15 years later it was way bigger.

Tony: I’ve thought a lot about that. The problem is that Apple had a retail operation. They had the manufacturing smarts.

Paul: It’s a whole other business.

Tony: What?

Paul: It’s a whole other business.

Tony: We didn’t have that kind of stuff. If we had waited, Apple would have come along…They wouldn’t have needed us for that. We might have been fighting over patents, and stuff like that. That’s my side of that.

Martin: Getting back to the nub of this, which we talked about just a couple of minutes ago with respect to the engineering, it sounds to me like what you’re saying is the entrepreneurial side introduces a natural, creative destruction into the technology business, which now, of course, touches on journalism. What we then hear back from that is…OK, what that probably means is more traditional journalistic institutions can continue to exist, but they really need to change. They really need to reduce their costs in particular. You hear this over and over again, this same theme of cost reduction.

The problem with that, when you talk to a lot of the folks on the journalism side, is that when you reduce the cost to a certain extent it’s not the same journalism anymore.

Tony: I think it’s a terrible dilemma. I don’t have the answer to it. I think the New York Times, Wall Street Journal, they can survive. If it’s so much more efficient, [inaudible 35:19] says, ‘None of my children read a print newspaper anymore. The problem is that you guys are trying to deliver it in print.’ I would say the problem was advertising. We had a great business. It was not exactly a monopoly. Just take the San Jose Mercury News, if you wanted to hire somebody back in the ’80s and ’90s, far and away the best place to advertise was San Jose Mercury News employment classified section. It was true with automotive. It was true with all kinds of things.

We had a great business, but there was a more efficient way to do it. That’s to deliver it electronically. If you could do it electronically, you didn’t have to go through the newspaper. You could use Monster. You could use Autobytel. You could use all these different services. You could then get in.

It’s self defeating to keep cutting the quality of what you’re selling, as then your circulation goes down. You’ve got to cut your costs. You’ve got to stay at least profitable enough to pay the bills.

I think it’s a terrible dilemma because of revenue…From the time we sold Knight Ridder in 2006, I’d say within two quarters of that, the revenue in the industry declined. In the fourth quarter of ’06 it declined.

It’s never stopped declining. It’s never stopped declining. At some point it’s got to get flat. Ad revenue’s gone from 50 billion in 2006 to last year, I think it was like 22 billion. What do you do if you’re a newspaper, like the San Jose Mercury News, and you’ve lost 60 percent of your revenue? You can’t just keep your costs up there.

I worry about the New York Times because they…I love the New York Times, but, you know, it’s not as much as it used to be, in my opinion. I mean, much meaning there’s just not as much depth there, it feels to me, anyway.

Martin: Well, I think the answer that is given, put the Times and the Journal aside, but in the more local space is that you have to go right down to the business basics and really size the cost structure to the ability to produce revenue. In other words, you take it back to a time when you didn’t have these big newsrooms, and a lot of folks would argue that with user generated content now and other forms of input you can do a whole lot more with a different set of processes. That’s the other side of the argument.

Tony: And you have to sell the content.

Martin: And you have to sell the content.

Tony: I mean it can’t just be an ad model. It has to be a combination of circulation revenue and ad revenue.

Martin: Well, I think you guys were the first ones to go free in the newspaper industry. Maybe Nando was before you, but I don’t think so. You were the first major newspaper entity to go free.

Tony: Free on the Web.

Martin: Free on the Web, right, and I assume you did that for the same reason…

Tony: We had big debates internally about that, by the way.

Martin: But we all did it for the same reason. We needed to build an audience.

Paul: And you did it at the Times, and I did it at Time.

Martin: Right. But, you know, there’s now a lot of second guessing on that, you know. How do you feel about that?

Tony: I don’t think that was the wrong…I don’t think that was a bad decision, because we had to build up a big enough audience so we had something to sell, and I don’t know if we would have built up that audience absent that, but I think that now the time has come that we can’t just rely on that kind of revenue. And I think it really…you know if you have…if you’re in a market like Wichita, Kansas, which is one of ours, or Oklahoma City, or Tulsa, or any of those kind of isolated markets, and markets where people really identify with the market and this is sort of been Walter Hussman’s thing in Little Rock, and it’s what Buffett’s talking about.

I think if you have a place like Duluth, Minnesota where I grew up, and people really care about Duluth, and they don’t move in and out much. They’re just there. They care about the local high school sports. People that don’t even have children there go to the high school sports or hockey games, or whatever. And they would pay for it.

But I don’t know what you would do in markets like San Jose where people don’t really identify with San Jose. They’re just there. They love living there and working there, but that’s a much tougher thing. They don’t care, necessarily. There are people who care about the high school sports, but that model is very different.

But I think in Omaha, where Buffett now owns a paper, it’s crazy now to sell the content. And I feel the same way about the New York Times Company. And I’ve felt that way for some time, and I’ve said that to Arthur. ‘I think it’s just…you’ve got unique content,’ and this if before he started doing it. ‘And I don’t understand why you’re not selling it, because where else can you get New York Times content?’

Martin: Well, it’s turned out to be successful. I think, again, the issue that not just the New York Times and not just the newspaper industry faces, but the whole Internet media industry, is the notion about kind of falling knife on the advertising side, and so overcoming that is a difficult…no matter how much you charge for the content you still need to have the advertising stream kick in, otherwise you’re selling a high class newsletter, basically.

Tony: Right. But, you know, if you’re in Omaha, I think there’ll always be a business for that kind of newspaper, and if you force people to pay for the content on the Web, then…or do it like the New York Times model, which is if you pay for the print you get it free on the Web, but if you don’t pay for it on the print, you’ve got to pay for it on the Web. That to me, if I were still a CEO of Knight Ridder that would be our model, I think. But it’d be much tougher in Philadelphia than it would be in Kansas City or Wichita, I think.

Martin: So getting back to the history of Knight Ridder, at one point I guess you didn’t have an A/B stock structure, right? You were just out there exposed.

Tony: No, we did.

Martin: Oh, you did.

Tony: We did not.

Martin: You did not, right. You did not. So there was a hedge fund guy or something like that that come in. What was the…what’s the story of that?

Tony: OK, well, what happened was…we only had one class of stock, and Gannett had one class of stock, and I think, basically we were the only two companies that were in that position. So we had three shareholders that were large shareholders, but the one that was the largest was a…he was part of T. Rowe Price, but it was called something else, but it was owned by T. Rowe Price. And he was…so he said, ‘I think you should sell.’ I mean he had talked to me over some period of time, and I kept putting him off. And our second largest shareholder thought we should have a recap. Are you familiar with recap?

Martin: Mm hmm.

Tony: What I mean by that? Yes. And just borrow a lot of money and buy back a lot of stock, and then we had a third largest shareholder. And all together they added up to about 35 percent, 40 percent. And so, you know, finally they got together, and they finally, all three of them, thought we should sell the company, but we had a provision that if we were sold and we would have to have a…that it would require 80 percent of the shareholders to approve it, which meant that we were pretty well protected, I mean, to get 80 percent, if we’re fighting it. But we looked at the business, and we had been losing even though our numbers, our total ad revenue, our total revenue numbers, ad revenue numbers, we were going about the same as the industry. There was no difference.

And even though we had a lot of cash flow I mean we were generating like 600 million dollars year all of our revenue growth, plus some, was coming from the Internet, and it was masking the overall, because we weren’t breaking them out separately. So our print revenue had been declining since really the early 2000s.

And so we talked about what kind of a story do we have to tell to the advertisers? I don’t mean the advertisers. I mean the shareholders. ‘Stick with us because things are about to get much better.’ And I didn’t believe it, and I felt we’d end up with a big fight with these guys, and we’d could hang in there sort of like the New York Times has hung in there.

But I asked my senior people how they felt about it, and they just didn’t see…I mean there wasn’t one person that thought, ‘Boy, you know, we’re just going to go through a little downturn here for a year or two,’ and so we decided not to fight it. But I think we could have fought and won, but it just would have just been dragged on.

And, you know whereas Arthur and the Sulzberger’s could just say, ‘Go to hell. We’ve got two classes,’ we’d be constantly going through that, and what would happen in the meantime? Did we think…if the business isn’t really growing what’s going to happen throughout all that? Do you save [inaudible 47:53] the employees?

And I knew McClatchy was really eager to buy it, and they were a really quality company like we were. They had two classes of stock so it seemed like a good outcome, and they were the only people that bid for it. Nobody else bid for it. So that seemed like a good outcome, but that was really painful.

But I did recommend to the board that we sell it. When the board saying…tell me we want you to sell, I did, and my senior management team all agreed with me to a person. So there wasn’t anybody on the senior management team that said, ‘This is the wrong thing to do.’

Paul: That’s a, I would say, probably a pretty rare brutally honest look by the management team at its own future. I think generally management teams are pretty good at convincing themselves they’ll work their way out of it. Why do you think you were able to take such a clearheaded look at that, pointing the team could, too?

Tony: Well, I think because one thing when Sherman came to me I said, ‘Look, why don’t you go after Gannett? They’re the same as we are. They’re no different than we are. Go after them.’ ‘Well, because they’re big enough to buy you, and you’re not big enough to buy them.’ And I said, ‘Well, go after somebody else.’ ‘I mean where are we going to go? We can’t go to the New York Times Company.’ He was a big shareholder in the New York Times Company, by the way. ‘We can’t go to McClatchy. I mean all these other companies…I mean you and Gannett are the only two, really.’ The Tribune had this kind of funny deal, because they had the McCormick Trust, they had the ESOP. They weren’t in the same position we were, because whereas we had a really broad base shareholder thing.

So you know, I think that it just didn’t look like…you know, it looked like we’d just keep fighting with these guys, and where would this all lead? And we ended up voting and they can’t…the company’s not sold, but when you’re going through all that, it’s really destructive to the employees, the company. I mean it seemed like just a bad outcome, and it seemed like McClatchy was a good outcome. But it was really painful, personally, for me.

Martin: Last question that I have, we have this metaphor that we use to kind of describe the whole history, which has to do with the swimmers and the tide, and the tide is basically the march of technology and entrepreneurship, and the swimmers are the folks making the decisions, people like you, throughout the history.

Tony: What do you call it, the tide and the tremors?

Martin: And the swimmers.

Tony: Oh, swimmers. Yes, yes, yes, OK.

Martin: And I guess the question is, even if you have a bunch of Olympic swimmers [laughs] , the tide is so hard, they’re probably not going to make it, and you know, it just seems sometimes…and Knight Ridder was probably a pretty good example of this…that this was kind of almost inevitable, that no matter what decisions anybody made, the technology was just going to overwhelm, the tide was going to overwhelm, these people who are trying to swim through it.

Tony: Yes.

Martin: Is that true, do you think?

Tony: I do think it’s true, and I mean I…we didn’t see, and I didn’t see, what was going to change this trend. And as I said, if you look at the print, if you go back and take out the Internet and look at the print and what this long slow decline that we were in starting in 2000, and that it was going down, and so when we’d get together as a group, including with the publishers, what is going to change the print? Is the print…is there…can anybody figure out how we’re going to…if this is the trend line in the print, what’s going to change that print line? And nobody could see what was going to do it, but I do think if you know that you have these guys…if you have one class of stock, and you know that you’re sort of unprotected, you maybe look at things differently than if you know that you could just tell them to go jump in the lake.

But I don’t…it’s been six and half years since we sold the company, and other than the availability of the iPad, there isn’t anything that’s really changed in the industry. I mean it’s not like two years after we sold it somebody finally figured out…

Paul: Found the Fountain of Youth.

Tony: What?

Paul: They didn’t find the Fountain of Youth right after you left.

Tony: And they’re still wrestling with sort of the same kind of stuff that we wrestled with for a long time.

Martin: Yeah, I think one of the things that’s happening, that the Newhouse folks have taken the New Orleans paper as an example down to three days, and people are experimenting and things like that.

Tony: They’re doing Cleveland now.

Martin: Cleveland, yeah.

Tony: They’re going to do it in Cleveland. People must say, ‘That must make you feel good that you got out when you did.’ It does not make me feel at all good that it’s come to this, because I think it’s incredibly sad for the country, because most newspapers have to cut back. It’s the only way they can survive. And as a result in Monterrey, in San Jose, wherever you go, the citizens of these communities are not getting the kind of newspaper they deserve, and the politicians are able to do a lot of stuff they couldn’t do before and there’s…our watchdog role is really diminished across the country, and it’s not getting any better. It’s diminishing even more.