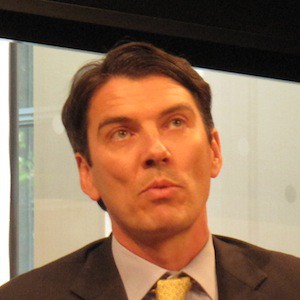

Randall Rothenberg: Martin, thank you for joining us.

Martin Sorrell: Pleasure, Randy. I say that before. Whether I’ll say it after is another question.

Randall: Hopefully, it will be.

Martin: It will be.

Randall: I’ll reflect…

Martin: I assure it will be wonderful.

Randall: “Riptide,” as we were just speaking, is an oral history of the Internet and journalism and trying to rip out the past in full.

Martin: “Riptide” suggests that all of us are being engulfed by this, doesn’t it?

Randall: In fact, that is one of the questions I want to ask. The project uses the metaphor “riptide” to describe a process that’s pulled traditional news organizations further and further out to sea.

Martin: Yeah.

Randall: One of the first questions that we wanted to ask you is, as you look back, is there anything that news organizations in particular…

Martin: News organizations?

Randall: News organizations.

Martin: By that, you mean TV news, newspaper news, and magazine news?

Randall: Yeah. I would take news organizations to be broadly the non-fiction media business.

Martin: Because so far, the media that have been most affected have been newspapers by, let’s say, disintermediation or by the digital revolution, whatever you want to call it, by Google, or whatever. So TV news, magazines probably less so, but there are signs that free to air television, if you look at the latest Nielson data for the last year or so, particularly amongst the young, that their circulation, their viewership, is declining quite sharply. In fact it’s very reminiscent of the stuff I used to see: The “Washington Post” circulation data, particularly amongst younger people, even pre-Google.

I mean talk about PG and PG, pre- and post-Google, a decline in readership. I think some of the stuff you’re starting to see in television, free to air television, if not mirrors it, is trending that way. But it…

Randall: Do you think the causes are the same? Is it purely a function of much, much, much more supply of content chasing…

Martin: Supply of content and devices, changes in devices, obviously, tablets, and smartphones. If you go to fast growth markets, what others call emerging markets, what you see is the mobile phone and now the smartphone taking share from the PC. In the Western markets, we went from analog to PC to mobile. In the faster growth markets, like a Brazil or Russia, India and China, Africa, you’ve skipped the PC almost entirely. You see now the PC manufacturers coming under pressure. Today we’re going to hear whether Dell, Michael Dell buys back Dell. But if he fails to sell out it’s because they think that the prospects for PCs, and you see it with PC software with Microsoft or whatever, the demand for PC devices and PC software is diminishing.

But is there anything they could have done? I think there are three things that we’ve always talked about. One is that you should pay for content, the paywalls. People used to laugh at us 5, 10, 15 years ago when we said if you have valuable content, you own valuable content, you should charge for it, and consumers will be willing to pay for valuable content.

Now news is a commodity. The faster you get it, the better it is. Whether people would have been prepared to pay for faster release is one thing. But there are brands. I go to the BBC website because I trust the brand at two levels. One is I trust it because of its editorial independence. The second thing is I trust it because it will not mislead me in terms of the quality of what it does and the quality of its journalism. Would I pay for the BBC? Yes, I would pay. One thing was paywalls.

Randall: Well you do pay for the BBC, in that case…

Martin: Yeah. Well I pay a funding license, yes. But if I’m now looking at my iPad, I don’t have to. I’m doing…

Randall: Right. But you still do it. That’s an interesting point, because you have a choice, yet you still choose to pay.

Martin: Yeah. Yeah. One thing was paywall. Second thing was consolidation. That the industry was too fragmented. The third thing was that if we want to maintain professional journalism, you have to pay for it. In other words if you were a professional journalist, which you are, at least in part, would I be willing to pay to hear what Randy Rothenberg says about things? The answer’s probably yes. If not, and I think you’re worth preserving, or the state thinks you’re worth preserving, then they should subsidize. You did get that.

For example, I always remember two things. One is that, I think it was the FCC in America did talk about, at one stage, getting a fund together to invest in the legacy media that was most threatened by the Internet, newspapers, for example.

The second thing was that television stations in Australia were given subsidies, effectively by giving fees back for what they paid for bandwidth or whatever it is they paid for. They were given money back because they were suffering so much from the digital revolution.

I think there were things that you could have done to ameliorate it. But I was always struck, I think the most powerful quote I can remember is Jeff Zucker’s quote where he said, “Analog dimes into digital pennies.”

Nobody, to my knowledge, has managed to navigate, to change the engines on the airplane while it’s flying. To navigate successfully from an established model, a legacy model of newspapers and news, to a digital model. As profitably as they used to when they were felling trees and distributing newspapers.

Randall: Do you think, as you look at the main news organizations…keep in mind when mentioning the phrase news organizations, is there anything that you can see them doing now? We have the benefit of hindsight. What could they conceivably implement now that might save them?

Martin: Well it’s very difficult, because…I do think, if you think about Google and you think about Sergey and Larry, at the heart of what they’re doing, what are they doing? Of course they, when Eric was CEO, I think it was much broader organization. I think under Larry it’s become more focused, if you like. But if you thought about what was their principal operating principle, it would be disintermediation of established business models and providing you and I as consumers with a cheaper alternative, a better-value alternative.

We used to have to contend with the tyranny of distance. If I traveled to New York, I wouldn’t know which hotel rooms were free and the prices. I would have to telephone them all up on a land line or I’d have to journey around to find out.

Now, literally with a click, and somebody can tell me, I can put in my likes and my preferences and I get it instantly. Inherent in the digital revolution is benefits, productivity benefits, and price value benefits for you and as I consumers.

In a way, I think this is an industrial revolution that probably, for legacy companies, is very difficult to deal with. If I look at WPP, for example, if I took the last 13 years since the turn of the century, our business has become a third fast growth markets and a third digital. The fast growth markets did exist in 2000, but they were, instead of being a third, let’s stay 10 or 12 percent. Today, both of those activities account for roughly half the company.

Randall: We’ve seen that the real impact of Google and of the Internet generally is providing access to information that once was closed. Most existing companies and most industries profit by having a, I think this was Ronald Coase’s Nobel prize, by basically being able to close off or own the access to certain information.

Martin: If you remember, I struggled with economics at Cambridge. Those supply demand models, they used to have a couple of things, which are actually very important in the context of the development of WPP. First was free trade, so you didn’t have any tariff barriers or other things, and the world got freer in terms of trade. There’s still tariffs and protections and trade agreements, et cetera. But, essentially, it’s a freer world than it was when we started WPP in 1985.

The second thing is perfect flow of information. That there were no blockages. What the Internet has done, what Google and Twitter and Facebook and Instagram and everybody else has done, has enabled a freer and faster flow of information, which has empowered you and I as consumers, to a degree. You referred to these closed models. People traded in our ignorance or lack of understanding or lack of knowledge.

Now it’s very difficult…you can talk about transparency. In fact, we worry that we’ve gone too far. PRISM and the NSA and all this stuff worries us that maybe it’s too open and that it’s too transparent, that the pendulum might have swung too far. But basically, it enables the supply and demand model. You could argue (it allows) capitalism to function much more effectively and much more efficiently than it did before.

Randall: Yes, it was those two things. It was trade and asymmetry as it became more symmetrical, information asymmetries became more symmetrical.

Martin: Yes, that’s right.

Randall: When did you first realize this?

Martin: Well, I was thinking about…well, I don’t know if I realized this, but when did I first think of…I think it dates to when I saw those people with satellite phones that you…I didn’t have a mobile. I used to have to get out on the motorway in the U.K. and go into one of those red boxes and put, I think, four pennies in, or three pennies in, press button A, and if I couldn’t get through I’d press button B and got my money back. If I got through…the phone would go, somebody would pick up the line, you’d press A and you’d lose your money – well, not lose your money, but to pay your money. If they didn’t, you’d press B and get your money back. I don’t know how we coped. I mean I know that when I went up to Manchester by car we’d stop off at the service station halfway up the M1, or whatever it was, and spend half an hour catching up on what had happened.

And then I saw these people with bat…not bat phones, because they were enormous, right? They’d be in the jungle somewhere with these great clunky great things with a satellite dish, or whatever it is, or they’d have the first mobile phones, which were these bricks that they used to carry on with their ear. It’s a bit like having an iPad to your ear, or whatever it is at the moment, but very clunky. I think that’s the first time that I really started to think about what the implications are.

Randall: This is late ’80s?

Martin: Yes, it would be late ’80s, early ’90s. It was really with the growth of Vodaphone, actually, when Chris Gent started Vodaphone. If you remember, Vodaphone came out of…it was a fragmenting of a company. I’m trying to remember who it was who took the Vodaphone license, the wireless license, and started up. It was a famous industrialist in the U.K., and then Chris Gent took it and built it by acquisition. I think it was probably, to be fair, with the rise of Vodaphone, and AT&T, let’s say, in the United States, and as they started to negotiate and navigate the mobile, the growth of mobile, because I think that was where we first started to play with it.

I mean you could go back further and when I graduated from business school in ’68, and I went to Glendinning Associates. I had worked on the basic programming language with those big mainframe GE computers, and I remember I irritated my first employer enormously, because he asked me to do a very simple programming, and I was useless at that. I wasn’t a software engineer by any means.

And I got it into a continuous loop and the machine was outside his door so the machine just kept on spitting out the same information for about two hours. And he came out of his office in a fury, who is this idiot who had left the machine on all the time? I mean you could date back to that. You started to think about the impact of computers.

Randall: A different context, though, because when you and I first met…

Martin: ’85. I would say the late ’80s you began to think about it, because you started to see the…I think the mobile revolution is when we started, really, to think hard about it, and then that was accelerated enormously by the founding and development of Google, the fact that kids could drop out of…well, Microsoft, I guess, actually – Gates and Microsoft.

Randall: Do you remember when you saw your first banner ad?

Martin: Oh, I can’t remember the date. I mean I don’t think I was really…I think that the biggest impact was the mobile revolution, actually. I think that sort of was where you started to think about what was the implication for productivity and behavior of what was the beginning of a digital revolution.

Randall: Which is interesting because in a way that started very early.

Martin: Yes.

Randall: I remember when I was living in London and seeing all these people walking around with big mobile phones and joking about it, and then, of course, the PC thing happened and the Internet, and you kind of forgot about mobile, but in fact, that’s…

Martin: And now it’s superseded it.

Randall: Right.

Martin: Because it was the development of clunky handsets. Now we’ve got smart headsets or handsets which revolutionized it. I think, obviously, the PCs accelerated it, PC software accelerated it, display ads, banner ads, all accelerated it, but if you said to me, “What was the first time that you really thought about the big changes?” it was the fact that you didn’t have to go to a callbox or to a landline, that you could be totally mobile and talk to people and receive messages, and I think that was the first.

Randall: You mentioned Google several times.

Martin: World’s most valuable company when you strip out the cash, more valuable than Apple.

Randall: Well, it’s unless…what’s the word…naturally be more valuable, because it’s effectively less hardware intensive.

Martin: Yes, I mean I’m jealous of their revenue per head. We have in one way or another 165,000 people. If I strip out the associates it’s 115,000 people, and our revenues now are around 17 billion, and they’re more than double that, and I can’t remember how many people they’ve got. I think they’ve probably got about 25,000 people, including Motorola. Motorola added about twelve and a half thousand.

Randall: Yes, something like that, especially if you strip away those who…if you just focus on the core business, the revenue business, it’s even more…

Martin: The search business…

Randall: …jealousy…

Martin: …magical…and margins, as well. Fantastic.

Randall: You once famously described them as a, “frenemy.”

Martin: Yes.

Randall: I think that was at a Google Zeitgeist conference as I remember.

Martin: Yes, and it was a woman called Lauren Reese who was on our…is the daughter of a hedge fund manager, Rick Reese, who was a well-known media fund manager who I met through several transactions, and it was his daughter who was on our MBA fellowship program. And she said to me before the Zeitgeist or something, she said to me, “You think about Google as a, ‘frenemy’, as a friend or enemy,” or as a, “froe,” because at the Zeitgeist Conference it was Nikesh Arora who said to me, “You could call it a, ‘froe.'” But whatever it is, it was meant to…were they there to disintermediate us or were they there to work with us? I mean you’d seen this at Yahoo, to be fair. The guy before Terry Semel, who famously…

Randall: Was that Tim Koogle?

Martin: That was Tim Koogle, who ironically, Koogle, Google, Yahoo, etc….Tim Koogle went directly to our clients and attempted to cut out the poor old middlemen.

Randall: Right.

Martin: Terry Semel came in at Yahoo and deliberately…I remember his first act…in fact, that’s how I first met Linda Robinson. Linda Robinson had me to dinner with Terry and several other people to talk about how Yahoo was not going to do that. They were going to reverse that policy and work with agencies to build their business.

Randall: Can you…I’d love to…

Martin: Marissa…interestingly, Marissa is going through the same process of thinking about how she should go about it.

Randall: Well, I’d love to do a deep dive back into that time, because I was writing about the business… I was leaving journalism at the time, but writing about the business, hanging out at Wired, and one of the things that those early Internet companies were saying at the time was that they had no choice because the advertising agencies weren’t willing to pay attention to them. They were too new, too untested. So they had to…

Martin: I think that’s fair. I think that’s fair because, if you think about it at that time, the message was far more important than the medium. I don’t know whether it’s Marshall McLuhan or Vance Packard. I said it was Vance Packard and somebody corrected me and said it was Marshall McLuhan.

Randall: No, it was Marshall McLuhan.

Martin: Marshall McLuhan. So, McLuhan and the medium and the message, people running advertising agencies believed that the be-all, the end-all was the creative part of it, the Don Draper Mad Men part of it. We were Mad Men and it wasn’t about technology. And, more importantly, at that time, it wasn’t about media.

The media department sort of…

Actually, Mad Men, when the media director gets upset that he’s not a partner that was actually a fairly accurate…

Randall: That captures a real cultural piece of the…

Randall: …advertising culture …

Martin: Absolutely. It was the suits and the creative department and maybe the planners. The planners got in there, as well. But it certainly wasn’t the media people. They were sort of traders. Rather like in investment banks in the old days. The traders used to be the second-class citizens and the relationship people, the IBD, the investment banking division, was at the pinnacle. Those were the guys who generated the fees. Of course, it’s now the reverse.

In a way, we’ve mirrored that.

Randall: I’m really interested in that.

Martin: And the media people were not… They didn’t get the corner offices. They didn’t get the salary increases. They didn’t get the incentives. They didn’t get the Ferraris. They were…

By the way, in new business presentations, it was all about the suits, the planning and the creative. If there was any time at the end, you might have something about the media plan.

And then you got these Dennis Holtz, you remember, Michael Kasan, Westin International eventually bought by IPG. He was the first. Then you had the Gross brothers in France with Carat and you had the Rodaise family in Spain. You had Chris Ingram with CIA, which we ended up buying.

Now, they’ve all been absorbed. Even Aegis now, which was Carat, is now part of Dentsu. So they’ve all been absorbed because the people running the agencies are media people.

If I look at our businesses over the last 10, 12 years in particular, media has been the engine. You have to remember people look at WPP and say $17 billion of revenue. It isn’t. It’s $70 billion of media that flows through our business that we, on behalf of our clients, manage.

Randall: So wasn’t it… Go even back into the prehistory, wasn’t it always true that all the money came in through the media, but culturally the influence was…

Martin: Oh yeah, it was. But, to this day, very interestingly, we are the only company… I think Aegis did it, as well — but we are the only company that shows its billings and its accounts. I think that’s a fundamental mistake because the power of our business, to some extent, rests on our ability to make…

Irwin Gotlieb coined the phrase, “media investment management.” We’ve now bastardized that into our consumer insight division, called it data investment management because these two areas…

We manage an investment portfolio, effectively, for our clients of $70 billion. We run a $70 billion fund where we decide whether that’s the right number. Should it be more? Should it be less? And which, in an increasingly fragmented world both geographically and functionally, where’s the best place to invest that?

Randall: So, if we’re thinking about this chronologically, we go back into the prehistory, the money flowed in through the media function, but the culture and power was creative and relationships. Then a set of independent companies, media, independent media agencies come into existence.

Martin: And the creative companies started to lose media. I looked at Ogilvy and Thompson, I think it was in the early ’90s, I remember we looked at it in London and we’d lost so much media revenue because these media independents were popping up all over the place. We said to the people, at that stage I think it was Chris Jones running JWT and Shelly Lazarus at Ogilvy, so it would have been the early to mid-’90s, “You’re losing your media. You’re losing out on your media business. We’ve got to do something about that. We should set up Mindshare.”

We didn’t call it Mindshare at that time.

Randall: Clients started unbundling their options.

Martin: Absolutely. And it’s the benefit of functional specialization. The irony of all of this is that WPP, Omnicom, Publicis, IPG are all really full-service agencies that existed in the ’50s. It’s not different to the JWT of Berkeley Square. You walked in there in the ’50s, number 50 Berkeley Square, whatever it was, and you found Lexington PR, which is now Hill & Knowlton. You found BMRB which is now Cantor and Research.

You found an operations research company because, when they came up with the idea for Mr. Kiplings Cakes, which was residual dough from bread making, I think it was, and Mr. Kiplings Cakes, they, JWT research department, the precursors of the Mad Men, laid out the factory. Actually drew a plan of the factory and how the factory would function to make the Mr. Kiplings Cakes, which became a famous brand.

What we’ve done is created more vertical specialization. We’re now busily building horizontal integration to get everybody to work together. But the analogy is sort of to a house where you have strong columns and a roof that you support rather than having a very strong roof with weak columns.

So strong functional specialization.

Randall: This recognition and this re-organization of the agencies is really happening at roughly the same time as the Internet.

Martin: Yes, the digital thing accelerated it because it put more emphasis, it was a secondary I think. But what it did was it said, “Not only is the medium equal to the message, but the medium is going to become faster, equal, or even more important, because the medium is fragmenting.” You don’t have to just worry about offline. You have to worry about online, too. And online, by it’s nature, is much more fragmented because it’s much more tailored.

Randall: So Google, when does Google really enter into your consciousness?

Martin: Middle to late ’90s. I think I’m quoted in the Harvard Business Review in 1995, I think it was, as saying the Internet was going to… I don’t think it was exactly the most prophetic statement, but, “The Internet was going to make a substantial difference to our business and our lives.”

Randall: But Google started later.

Martin: Yes, but people started to look really at the Internet pre-Google. We started to look at the implications of it. Google really accelerated it. The ramp-up on Google was so strong and so quick, and the story was such a romantic one and they were very broadly spread in terms of what they set out to do that I think it started to have an effect quickly. I would say pre-Google, middle of the ’90s, late ’90s.

Randall: At what point did the notion of, personally, of Google as foe or frenemy really occur to you?

Martin: We were always terrified. Not terrified. We were always worried. Analysts would say to us, “Are you going to be put out of business?” Clients would be looking at their developments and saying, “What are you going to do about it?” Our people…Just like the people in our business who had the power in our business, which were the suits and the creative, let’s put it like that, just like their attitude to media were not right. The funny thing was, they only changed their attitude to media when they were in trouble.

You asked could we have done anything, could news organizations have done anything about the digital revolution. The fact is can you ride the waves. You think you can roll back the sea, and you can’t.

If you said to me, “What do you regret about WPP over the last, say, 13 years is that we haven’t done more faster growth markets and we haven’t done more digital. Because the benefit of 20-20 hindsight, if you had done those deals that you had thought were marginal, if you had taken on those people that you thought were not fundamental and not core, and were marginal, you would have invested in more human capital in the digital era and you would have invested in more companies.

Randall: There is a little bit of unfairness in that, anyway. Because, the responsibilities as a publicly traded company, differ from the responsibilities of a venture company…

Martin: Yes. They look for different things. The simple fact is it’s more, if you run a legacy business… We have to change the engines on the airplane while we’re flying, just like newspaper companies had to or TV companies will increasingly have to. That makes it much more difficult.

A venture capital company also funds a company which has no legacy. So it doesn’t fell trees and distribute newsprint. It makes a digital magazine or newspaper. So it’s much easier.

It has none of the attitudinal, the soft or the hard, the infrastructure problems. It has no infrastructure to service with a cash-flow profitable operation.

And the VCs look at internal a different way. They look at top line and top line growth. They don’t worry about margins. They worry about hits, circulation, views. They don’t really worry about the traditional. They don’t worry about return on capital.

They worry about ramping up on the top line as rapidly as possible. And often, if the thing makes money, it’s a problem. You remember Internet 1.0, the cash burns, all those companies that went out of business because they were burning cash too fast.

Randall: I want to ask you one more question about the media agencies and the intersection of the unbundling phenomenon and the Internet. If we go back through the history of advertising, I think you can argue that agencies and the publishers, the media, were kind of in a healthy collaboration with each other. Rising media prices were good for the media and were good for the agencies.

Martin: A bit like real estate agents who are pricing houses. You’ve got remunerated on a percentage of the value on which the deal got done which, from a client point of view, was the wrong thing.

Randall: Right. At some point, there are a couple of points where things change. One was arguably, media as a commodity, became less valuable because, in a digital world, supply would always outrun demand.

Martin: I’m not so sure that it was that. I think that people began to wake up to the fact that it was made in an inflation environment, and you’ve got to remember inflation really peaked in the late ’80s when a Kraft cheese single I remember, in Chicago, was twice as expensive as a private label. I remember thinking to myself, I wrote it in the annual report in 1989, “This can’t last. It’s crazy.” But inflation, and since 1990, we haven’t had much inflation. Having gone through that, clients realize that it didn’t make sense to incentivize us, either from a creative point of view…

If you were working for Proctor like we did at Saatchi on Charles St. pre-1985, on Pampers Diapers, we worked on it for free because there were no billings, therefore we didn’t get 15 percent or 17.65 percent on cost for production, etc. What we had to do was wait until they launched, which would take four or five years. But when they launch, my God, they launch.

Proctor would launch and say they have a share objective of 10 percent and they spent money on TV until they got to that share. They didn’t stop. We were rolling the 15 percent on the 30-second ads or the 60-second ads or even longer, 90 or two minutes. We were rolling in.

So it was a very different…but I think clients…and then with the rise of finance and procurement in ’90s, people started to say, “Are there alternative models that make sense?” And what we do is invest time.

The pity about our industry is the brilliance of the idea doesn’t often result in us being brilliantly paid, but you could argue that the old system did that better because if it was a brilliant idea they’d run it more and you could get more commission.

But, essentially, I’m not sure that it was to do with the digital revolution. That might have accelerated it, but I think fundamentally clients realized – quite rightly – that paying people just on the price – that the bigger the price, the more we made – was not the right economic model and that we should have skin in the game. We should have fees to cover our overheads and a normal level of profitability and our direct costs, but then we should some incentives, keyed to market share, or sales success, or whatever, and often we don’t have control of them.

Randall: There were a number of factors. So inflation went down. Media inflation went down. Clients became more procurement oriented, so really inspecting things more. I think the Saatchi bank acquisition probably had a role in that at least in making people respect their fees.

Martin: Yes, I think that’s with all due respect probably a more looking at from this side of the water. I mean there were some extraordinary characters involved in that. I mean there were…in a way you were right, because it did…it had smacked a little of the “Barbarians at the Gate” and over-ambition, and people packing guns, and all that sort of stuff. I mean it was pretty hairy stuff. It would have made a great Mad Men sequel. But there was a bit “Bonfire of the Vanities,” that stuff.

Randall: But the net result was that the fee structure changed the conversation structure…

Martin: Yes, the domestic servants were getting out of line. That was why probably clients felt that basically the agencies…now what’s interesting to your point is that subsequent to that as a result of the pressure in the system, whether it be the rise of finance and procurement now particularly post Lehman, but I would argue since the early ’90s, since the end of inflation, major inflation at the end of the ’80s, and the evils of inflation. And I would argue you could argue because of the Internet revolution. You could argue because of this pressure on costs that clients in a slow growth world have. As a result of that agencies consolidated even further, and the range of choices to clients has diminished, actually.

I mean if you think about if you’re going to do a worldwide campaign, if you accept that a small agency in New York, or London, or Paris, or whatever, can’t handle it, and that you have to have a network, your range of options, if you think about it from a holding company point of view, is probably down to about four or five.

Randall: Right. So is it fair to say, is it fair to conclude that from all of this that in the balance of power between media and agencies, agencies began to become more powerful…?

Martin: Well, agencies became more powerful because they took the media function. So the media function it was split asunder from the creative. It’s not been sort of realigned, but in a holding company structure, the new 21st century full service agencies as opposed to JWT of Berkeley Square. And as a result what we’ve done with media is instead of having Mindshare, MEC, MediaCom and Maxus, we have GroupM, which goes to the market as one. Not in all markets. It doesn’t go in Brazil, but it goes to the markets as one, basically. And we have, if you look at our media shares, market shares, it’s anywhere between, let’s say, 25 percent or, let’s say, 20 percent up to 50. Some markets were 50 percent of the market.

So we can go and actually exert significant leverage in a constructive way, not in a destructive way, not in a sort of totally price driven way, but in a constructive way in terms of developing content, ideas, sponsorship as one. And if we represent 25 percent of the market or a third of the market then that’s a very strong negotiating position on behalf of our clients.

Randall: And you have more choices.

Martin: Yes. Well, we have more choices because of the digital revolution.

Randall: Right. More choices of media, right.

Martin: Absolutely. Well, we were getting more choices offline as well, but along comes Larry and Sergey and others, and Mark (Zuckerberg) and everybody else, and we now have more options. So we get interesting opportunities if we’re creative about it, if we’re not just creative about it, scientific about it as well.

Randall: For most of the first decade of the Internet revolution, though, the advertising and marketing communication support that was going to these Internet companies was below the line. In fact, the Internet was kind of a giant below the line medium. Brand advertising largely stayed away. Why do you think that was?

Martin: Well, I think it takes a long time for older people like me – not you – but like me to adjust. So I think…well, first of all there’s that. Secondly, the people who run companies tend to be those people so they tend to be conservative. Thirdly, the people who run companies demand strong performance, and you’re experimenting. You don’t know what these things…even today if you’re, let’s say, on calendar year, and you get to November, and you’re short on sales, and you have some resources, you’re probably liable to put some into the Christmas period on TV even now, right? Online is probably a slower burner with the exception of search. Google’s power is its search and mobile search, and the power of the algorithm.

And with that one exception you’re probably…you know, it’s sexy to invest in new media. You’re not going to get fired for doing it. You’ll get your headline in Ad Age or Campaign, or whatever, saying what a clever boy or girl you are.

But it takes time to adjust. I mean the simple thing it’s the old data that we use that Mary Meeker has developed. We know that newspapers and magazines absorb about 20 percent of our media investments as an industry, and we know consumers spend only about 10 percent of their time on offline on media of that type. On mobile and Internet we know they spend about a third of their time and yet we’re only spending 20 percent.

So those things have to adjust and they take time. So similar question – why is it with the change in demographics in America that people underweight Hispanic advertising, that they underweight Afro-American, that they underweight gay and lesbian advertising, that they underweight Asian-American advertising even though those people are the new mainstream?

Randall: Right.

Martin: And by the way you’ve only got to go look at why did Obama win twice? He won because he understood those demographic changes.

Randall: Right. Right. And they not only had the courage, but they had the necessity of putting those plans together to go for the those audiences.

Martin: Yes, so we consistently underweight…and there are companies now in America that say all their growth – all their growth – will come from that new mainstream, all of it.

Randall: So what I was getting at was a question of whether major news organizations, who are early many of them jumping into digital media, jumping into online, made a mistake in not trying to play to their historic strength, which is brand advertising, but going kind of willy-nilly down that path of below the line.

Martin: Well, they made a big mistake on the content issue. I mean a big mistake. Rupert was the first person I think to wake up seriously to the importance of pay walls. But, you know, I think it’s a tremendous difficulty, because it’s very easy to figure out Myanmar, or Vietnam, or the geographical changes. It’s much more difficult to figure out the technological changes. I mean you asked about whether these organizations could have done something 10, 15, 20 years ago. I mean it’s easy to look back and say, “Well, why didn’t we do that?” But it’s very difficult at the time.

Randall: OK, talk about the pay wall…

Martin: Because the valuations…you remember the valuations that Internet 1.0, and you take one of our competitors, Omnicom, which had the lead with Agency.com, and the other agencies just in the late ’90s. And then we had the Internet bust in 2001, ’02, and they got rid of all these assets off their balance sheets into that ill-fated thing called Seneca…

Randall: All right.

Martin: …which had to put it back once it got it sorted out, and I would argue that subsequent to that they decided that they weren’t going to take the risk. In other words, getting burnt made them shy, and today they’re not…I mean obviously I’m making a competitive comment, but they’re not as advanced as ourselves or others in terms of digital penetration. I think the reason is that they started off brilliantly. They were way ahead of the pack on it, but then they got burnt, and they decided to pull back. So it’s very easy to sort of criticize from the boundary, as we would say in cricket, but if you’re at the wicket or try to hit the ball out of the park, it’s much more difficult.

Randall: Even on the paid content front? I mean if you look at it is that something that could have been known at the time?

Martin: Yes, but I think even so…you know, strong news organizations, you see it with newspapers now. You know, if you said to me, “Why is it that newspapers…” I shouldn’t name names, but there are some really strong branded newspapers. Why is it that we don’t advertise even in the classical way – forget about digital – in a classical way more aggressively? Because they’re inflexible. Successful organizations tend to be arrogant. They tend to be overconfident, and that’s why they fail.

Randall: Well, I’ve told newspaper audiences when I speak to them that I first learned the term, “order taker” as a term of a program in the newspaper business when they were criticizing themselves as being just order takers and not developing the services or the products.

Martin: Yes, they think they have a sort of semi-monopoly, or whatever, and their brand is so strong that, “they will come,” and what people are looking for…interestingly, talking to newspaper owners currently, if they say to you, “What can we do that would help WPP, or GroupM, or Mindshare?” or whatever it turns out to be. It’s always that we say, “Greater flexibility.” And by the way, this boundary between advertising and content, advertorial, right, is going to get increasingly blurred. I mean I don’t think consumers should be misled. If it’s an advertorial it should clearly say at the top of the page, “This is advertorial.” But content, there’s going to be increasingly amounts of sponsored content, of content that’s developed for specific commercial purposes just as much as for editorial purposes, and the two things are going to mix.

Randall: This is called…this is now going…the faddish term for now is, “native advertising.”

Martin: Yes.

Randall: But you don’t think it’s a fad. You think this is…

Martin: No, I think it’s a way…you said what can people have done 10, 15, 20 years ago? They could have been much more flexible, actually. They could have gone…if it’s called native advertising, gone into that area or developed that approach, that flexibility, far earlier. Again, without naming titles I can think of two or three titles who the editorial people would say the business people they’re just not flexible enough.

Randall: When I took a brief stint away from the IAB, working with one of the major publishing companies, I remember talking to several CMOs at the time, because I was trying to get my bearing, and they all made that comment, and they also made the comment, “We’re not looking to fool anybody. We’re not looking to…

Martin: To mislead.

Randall: “…break the wall between the two. We just want to be part of the conversation.”

Martin: Absolutely.

Randall: And I remember hearing them say — there were three who all talked about the Huffington Post and said, “One of the reasons we like the Huffington Post is…

Martin: Because they’re willing to…

Randall: “…at least we can get in a conversation with them.”

Martin: Yes, in different ways.

Randall: Yes.

Martin: You know, people wouldn’t like wraparounds, right, on newspapers and things like that. They would say there’s no way that we’re going to allow some sponsor or advertiser a wraparound, and that started to change. And I don’t…again, I’m delighted. I’m not suggesting we mislead consumers, and we should be clear about that. You see that now with online. I mean in an opt-in, opt-out, when we’re asked to opt-in to something, and we have to go through these 25 pages of…well, actually I counted one site where it was a 60-page document that you had go through. It’d take you about three months and get a lawyer to go through it so it’s hopeless.

So it’s incumbent on us to come up with cheap and accurate ways of getting consumers to understand what they’re letting themselves in for, particularly when the privacy debate has reached the degree that it has.

Randall: I wanted to follow up on that with you, but I wanted to ask one more question about native advertising, because you also mentioned earlier or referred to the importance of quality in the media, and you I think said, not just implied, that quality…

Martin: And it’s become much more superficial. I mean Twitter is superficial, right? The thought that you can reduce it to 142 characters, or whatever it is, is bizarre.

Randall: So is it your…?

Martin: Well, I remember, I was watching Charlie Rose one evening when I couldn’t sleep. I think it was in Shanghai or something, and he was interviewing the lead media guy on The New York Times. And Charlie said, “Where do you get your information from?” So I expect him to say, “Well, of course I get it from The New York Times.” No, no, no. He gets up in the morning and he goes to Twitter. That’s where he gets his information.

Randall: Well it’s a news feed. People set it up to be a personal newsfeed.

Martin: It’s a PR device.

Randall: Yes. Is your professional opinion now as the head of the largest advertising company in the world that quality in media matters to advertisers and their agencies, or is that too simplistic a…?

Martin: No, I think it does. I mean it shows what an old fart I am. I bemoan the rise of superficiality. I bemoan the fact…

Randall: You can bemoan it, but professionally…

Martin: Well, the downside, it’s the downside of Google, isn’t it? It’s not just Google. It’s the downside that we…it’s sound bites. It’s lack of depth. It’s, “Done this, move on to the next.” In a funny way when you’re successful you get no time to enjoy it. I mean at least when we used…when I was at Saatchi’s or the beginning of WPP, you’d announced your annual results, and we’d all go out and have a good lunch for about two or three hours at the end of the year to celebrate. You don’t do that anymore. You immediately move on to the next.

So there is no pause. There’s no relief, no chance, really, in that case, to celebrate success. On the other hand what you’re seeing is the lack of depth, and I think this is the real problem, a real problem.

I mean when was the last time that anybody really did a deep piece on WPP? I mean a really deep piece. And the answer is I’d have to go back to…there was an article done, I think, in Forbes about 18 months, 2 years ago where the guy took a month.

Randall: I thought you were going to say the late 1980s in The New York Times.

Martin: That’s true, but he took a month, and he wrote a long piece, but that’s the last time so now it’s bash and crash. And people look – and I accept this as a rule of the game – they look for the headline. They look for the…we were talking last night about some PR that had been done or articles written by some London newspapers on a certain situation and it was always…and people say always looking for the sensational. And you did when you were a journalist. You would look for the sensation. You would want…but it was…and it’s also about beating people. If Bloomberg gets a story, and Squawk Box doesn’t, I mean now you have the situation where Squawk Box says, “I’m not going to let…if you do Bloomberg you’re not going to come on Squawk Box.”

Randall: But what I’m asking is so that’s your moral, philosophical…

Martin: It’s not a moral…it’s a philosophical, more philosophical…

Randall: As a media investment advisor, which is what you are…

Martin: I think quality is really important, really important.

Randall: OK. So when you think about…

Martin: Although the cult of celebrity [laughs] probably negates that.

Randall: Well, in the native advertising debate it’s an interesting one. Here’s a question: Can native advertising be reconciled with quality in media?

Martin: Well, I think it can be if you’re explicit. If you’re not, if you’re opaque about it, no. Now in this world you can’t be opaque about much I think. You have to be transparent. We see that every day. We’ve seen an example here in New York in the last 24 hours in the mayoral race. So it’s very difficult to be opaque about these things, and that’s that good side of it that you can’t hide things anymore, and if something’s naughty it gets exposed. The downside is it gets exposed quickly, and you move on to the next. I mean we see that…you know, see kids interviewed in school, “What you do want to be when you grow up?” They say, “I want to be famous.” What does famous mean? Well, then we go into, “Hello,” magazine, and, “OK,” and everything else.

Randall: For all the challenges that media companies have you made some investments in media.

Martin: Yes, a lot.

Randall: You invested in Vice media, among other things.

Martin: Yes.

Randall: It looks like it’s doing…

Martin: It’s doing extremely well.

Randall: So why is that? Talk a bit about your investment in Vice and what that implies about the evolution of the advertising agency.

Martin: Well, if I look at WPP, we’ve experimented. We’ve said if content is king – either traditional long form content or short form, or digital, or whatever it happens to be – if content is king we should be in those conversations. So we started out with Harvey Weinstein’s fund. Actually, I think even before that Media Rights Capital, which now have done, “House of Cards,” distributed with Kevin Spacey through Netflix, but we did, “Bruno,” and, “Borat,” before. So we’re experimenting with content. Imagina — we had 20 percent of a company in Spain called Imagina, which owns the rights to La Liga, the football league there, and also is one of the biggest, if not the biggest, producer of Hispanic content in the world. We’ve invested in Vice, as you say, in Peter Chernin’s Fullscreen, which manages 100 YouTube channels.

I mean we’re trying…I mean do we know? It comes back to what I said before. Geography I can follow. I’m intelligent enough to understand 60 million consumers in Myanmar or 85 million in Vietnam, and that’s got to mean something. It might be bumpy but it’s going to mean something.

I find it much more difficult to plot what’s going to happen technologically. So we are a strategic…going back to your point about venture capital investors – we are a strategic venture capital investor, right? We take a strategic view, which means we’re not as nasty on the financial front.

We don’t have such high sort of internal rates of return as private equity companies, which Steve Swanson always tells me, “You never come and take money from us because we’re the world’s most expensive source of capital.” Private equity funds because of their rates of return.

We’ve got a slightly more relaxed long-term view. And I think the analogy to the family wealth, private equity funds, the Banksias, the Santo Domingos, the 3G people, who take a longer term view. They’re not like Carlyle or Blackstone, the sort of as short-term private equity orientation such as TPG. We’ll take a 10-, 15-year view like a Warren Buffett long-term view.

That’s sort of like…We’re even less financially savvy or as focused as they are. We take a much more strategic view. But we wanted to be part of that content revolution. Not just traditional, but more importantly the digital piece.

A thing like “Vice,” which is very exciting, it’s great fun too, and breaks the rules. You go to Brooklyn and you see their edit suites…you see their editors. I think Shane is on the west coast this summer building edit suites or a facility in Venice Beach in LA. It’s very exciting, because it doesn’t obey the rules. You’ve got 18-year-olds at 12:00 on a Saturday night manufacturing content.

Randall: And it could mean something big.

Martin: Absolutely. Very big, very big.

Randall: Right. So part of the responsibility, and also the joy, I guess, of the…

Martin: Well, it’s another arrow in our quiver. I want to be able to say to clients that we have insight and sometimes we haven’t got it. But that would mean that we go to the outside to get it. We don’t have to own 100 percent of it. We don’t have to own even 51 percent of it. It can be a minimum…It can be Omniture, Buddy Media. Buddy Media was a platform. It’s now part of Salesforce.com. Omniture went to Adobe, but was web analytics. Buddy Media was a platform to use Facebook, which our clients were confused by, our people were confused by. But in both cases, of web analytics and the Facebook platform, we had 500 people being trained so they understood more, clients included. They understood more about the potential of Facebook or the potential of having a web analytics dashboard that…

Randall: Right, so the strategic investment was also a method to do training for a large chunk of the organization.

Martin: Absolutely, and that was very important too. But it really was to get a better understanding, because a lot of this stuff is confusing. If I say I’m confused by technology, I think most clients…I mean, it is true that our client is changing. It’s no longer just the CMO or the CEO. It is more the CFO, the chief information officer, the chief procurement officer, and most importantly, the chief technology officer or chief information officer. And then there’s the big debate. Whoever was going to do the oral history of advertising in 10 years’ time, it would be very interesting to speculate as if you were talking to whoever is the largest advertising and marketing services group in the world, what they would say in 10 years’ time about who their client is, because we are starting to see…and then there’s this debate in the trade journals as to who’s going to control that. I think that’s less of a thing.

What you have to do is think about the fact that we are no longer just an art. The difference is, 20 years ago, we would be having a purely artistic conversation. There would be doubts about the media being that important. David Ogilvy had written 50, 60 years ago the importance of one-to-one communications, direct and direct mail.

Randall: Well, he came straight out of the tradition.

Martin: And research as well, Gallup, etc. So in a way, as with many things if not all things, David was very much ahead of his time. He didn’t think about it in terms of a computer or in terms of algorithms or Facebook or whatever, but he did understand that tailoring, having a message on a one-to-one basis, in his case by mail…you know, it was called Ogilvy Direct. It wasn’t called Ogilvy One. Ogilvy Direct was a direct marketing, direct mail…envelope-stuffing company.

Randall: Yeah. But also importantly, and I’m not telling you anything you don’t know, is that he saw no distinction between that form of marketing and the creativity or the aesthetic appeal of the content of that.

Martin: Yeah.

Randall: He saw the two could be absolutely aligned.

Martin: Yes, I think that has changed. I do think the medium is…it’s certainly equal to the message. It may even be more important, which doesn’t endear me to certain people inside our organization, but I’m willing to discuss why that’s wrong. I don’t think it is wrong. I think the media part of the business…so if I look at the growth parts of our business for the last 5 to 10 years, it’s certainly the fast growth market that brings them to the next level, but functionally it’s certainly media planning and buying, what we call media investment management, and digital. Those are the big businesses that are growing very rapidly on a consistent basis.

Randall: Last topic, you mentioned privacy before. You’ve mentioned quite a lot in public that…I don’t know word for word, but you are a data company. You are in the business…

Martin: I would prefer to be an even bigger data company.

Randall: As you look at the…

Martin: The reason for that, just so we’re clear, is we want to differentiate ourselves by our ideas, or big ideas. If Dove wins at Cannes or an IBM ad wins at Cannes or a Grey’s Direct TV ads win at Cannes or whatever, that’s great. But equally, and, again, this is like the media and the creator, equally the role of data given the development of the new media is becoming more and more important. You can know far more about your clients without invading their privacy, without knowing who their names are or whatever, but understanding more and more about what their physical and emotional needs are.

Randall: Is this an area, the access to data, analyzing data in particular, collecting useful protected data, a way for media companies that might be challenged now including audience data….

Martin: Absolutely. We have our Twitter data alliance. We’ve already got some data which shows when people watch live television, which those Nielsen ratings are showing that fewer younger people are, but those people who are watching them, even younger people, have their other devices. They have their other media like Twitter and Facebook which they are using at the same time. They might be using their mobile phone and their Blackberry or their iPad or their iPhone at exactly the same time as they’re watching something on live TV.

Understanding through data how consumer patterns of media consumption have changed is absolutely critically important. We don’t tend to think that way. What’s going to drive us that way is our competitive set.

We always thought, “research, it’s going to be a dull lunch.” We’re Hollywood agents and you’ve just seen Harry do his deal with David Droker. Nothing is new in our business in a sense. But the competitive set is not just Omnicom and Publicis and IPG and Dentus.

The competitive is Google and Facebook and maybe others. These are not technology companies. These are media owners. The competitive set is some of the consulting companies like Deloitte and IBM and Accenture.

These are all companies which are looking at the marketing space, and they come at it from the technological end whereas we come at it from the creative end. My view is we have to be a creative business, and that’s paramount.

I would even argue that maybe even equal to that, not subservient to it, is the scientific bit. This is no longer a craft business. This is no longer those private partnerships of when I was at Saatchi. I used to go and…Dancer Fitzgerald. You mentioned Bates, all those companies that were swallowed up.

They were private partnerships. They were sub S companies or partnerships where the accounts were distributed to the employees. I remember somebody at Dancer telling me, “Those brown backs that Arthur Anderson showed the net asset value. You were a share owner. You were interested in…” They were taken back from you at the end of the meeting. You never got to see them. Total secrecy.

Proctor was your client at 15 percent and 17.65 on production, and that was it. It was a license to print money. [laughs] It’s changed.

Randall: Using this argument and the way you kind of sketch out the competitive set, I can imagine…the question is, can you imagine. I can imagine that major news and entertainment organizations can also be part of that, but it requires them to reconfigure and grow new capabilities.

Martin: Absolutely. You’re seeing that, but I don’t think many, if any…I’m a great admirer of NewsCorp and I think Rupert understands that, and James, Lachlan, Elizabeth, and members at the time. He’d acquired power from…The professional, the non-family members, they understand that. They really get it. They are a true media…I don’t like the word “conglomerate,” but a diversified media company, both geographically, in Turkey, in Germany, in Italy, in the UK, or whatever it is, as well as the US and then Australia, and functionally. Whether it was the right thing to invest in MySpace or not, Rupert did it, because he turned round and did his deal with Google, and people cried out, “Genius!”

They looked at MySpace at the beginning, and said, “Whoops,” and then, “Ah.” Now we understand. By the way, it’s very interesting. Companies that are owner-controlled are better dealing with this sort of things than bureaucracies. I don’t mean bureaucracies in a bad sense. I mean it as in managerial-led bureaucracies.

People who have a lot at stake, either reputationally or financially, are more likely to pound the street and pound the activity than people who are…There’s a separation between ownership and control.

Randall: How threatening do you think the current environment around privacy, regulatory environment, public sentiment…

Martin: I think it’s serious. I pride myself on being somebody who obviously knows about these things, or has an understanding. I presume I was surprised by it when they say I’m speaking to somebody from one Western government, I won’t say which, who said even the prime minister of that country was surprised, because security services, technically, particularly in this country, don’t report into the political structure. When the intelligence services swap information, or do whatever it is they do, they often do it without the knowledge [laughs] of the political bosses. Of course, then it puts people in a very difficult position. I think it is very important. I think even the younger people, who technically…Everybody says, “Well, they’re free,” but they release some information and they exchange some information, I’m not sure I agree with that.

We had the owner of Assembly come to the Cannes Stream conference, and we asked…even he was interesting. He said, “I don’t worry about putting stuff on the Web, but I worry somebody else putting a picture of me. That it doesn’t go through my filter before he or she puts the stuff.” There’s even a nervousness.

I think it is a difficult area. With Xaxis, which is our online media buying platform, we chose not to opt out, which would be the easy way out. With clients, you’re saying, “his is what we’re going to do.” We began buying this inventory. It would be opaque. Do accept it. We could write into your existing contract, which is not.

What we did was, we said, “We’re ripping up our existing contract. We’ll give you a new contract which embodies an opt-in procedure, because we thought that that was a more transparent way of dealing with it. It’s exactly the same.” I did go to the advertising bureau, to Brussels, to argue and make the case that we should have “opt-out,” which is what we use and the industry really wanted. That’s gone by. That’s finished. We’re not be going to be able to get away with that.

What we have to do is to have a simple opt-in process, so that consumers, and this will become even more important after present, they understand exactly what they’re letting themselves in for.